Table of Contents

Introduction

Nonprofit organizations in the US are required to file Form 990 with the Internal Revenue Service (IRS). This is a tax document that the IRS requires, that can help you understand more about a nonprofit that you are evaluating or are interested in working with. If you don’t have accounting training, or haven’t served on a nonprofit Board of Directors, you may be unfamiliar with this vital document.

This document is not intended to be professional accounting advice or replace the services of a qualified accountant. Always seek professional assistance to make sure you fill out this form correctly.

Finding The 990

There are a number of resources you can use to find an organization’s Form 990. Many nonprofits post their 990 publicly. For example, the Red Cross For example, the Red Cross includes a comprehensive list of financial statements on its website, including their Annual Report, their Form 990 and their Audited Financial Statements.

Additionally, there are several organizations that maintain databases of Form 990s:

- Foundation Center 990 Finder

- GuideStar

- ProPublica Nonprofit Explorer

Finally, the IRS includes a Tax Exempt Organization Search which can help you find an organization’s EIN (). This number can be searched to find the Form 990 and other documents.

Sections of the 990

The IRS provides blank copies of the Form 990, but it’s generally easier to look at a completed one to get a sense of the different type of information. There are 12 sections (called Parts) and 15 sections (lettered A through O) that can make up the Form 990.

Part I through XII

- Part I. Summary

- Part II. Signature Block

- Part III. Statement of Program Service Accomplishments

- Part IV. Checklist of Required Schedules

- Part V. Statements Regarding Other IRS Filings and Tax Compliance

- Part VI. Governance, Management, and Disclosure

- Part VII. Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and

Independent Contractors - Part VIII. Statement of Revenue.

- Part IX. Statement of Functional Expenses

- Part X. Balance Sheet

- Part XI. Reconciliation of Net Assets

- Part XII. Financial Statements and Reporting

Schedule A through O

These links take you to the IRS information on this schedule.

- Schedule A, Public Charity Status and Public Support

- Schedule B, Schedule of Contributors

- Schedule C, Political Campaign and Lobbying Activities

- Schedule D, Supplemental Financial Statements

- Schedule E, Schools

- Schedule F, Statement of Activities Outside the United States

- Schedule G, Supplemental Information Regarding Fundraising or Gaming Activities

- Schedule H, Hospitals

- Schedule I, Grants and Other Assistance to Organizations, Governments and Individuals in the U.S.

- Schedule J, Compensation Information

- Schedule K, Supplemental Information on Tax-Exempt Organizations

- Schedule L, Transactions with Interested Persons

- Schedule M, Noncash Contributions

- Schedule N, Liquidation, Termination, Dissolution, or Significant Disposition of Assets

- Schedule O, Supplemental Information to Form 990 or 990-EZ

Form 990, United Way of Central Iowa

Let’s review an actual Form 990. I picked the United Way of Central Iowa, an organization with about 30 million in assets.

Introduction

From the very top of the document, we can see the organization’s name, address and phone number along with the Employer Identification Number (EIN). We see the first date the corporation was incorporated (1918!), the website, and the specific section of the Tax Code that the organization gets its tax-exempt status (501c(3)).

Part I, Summary

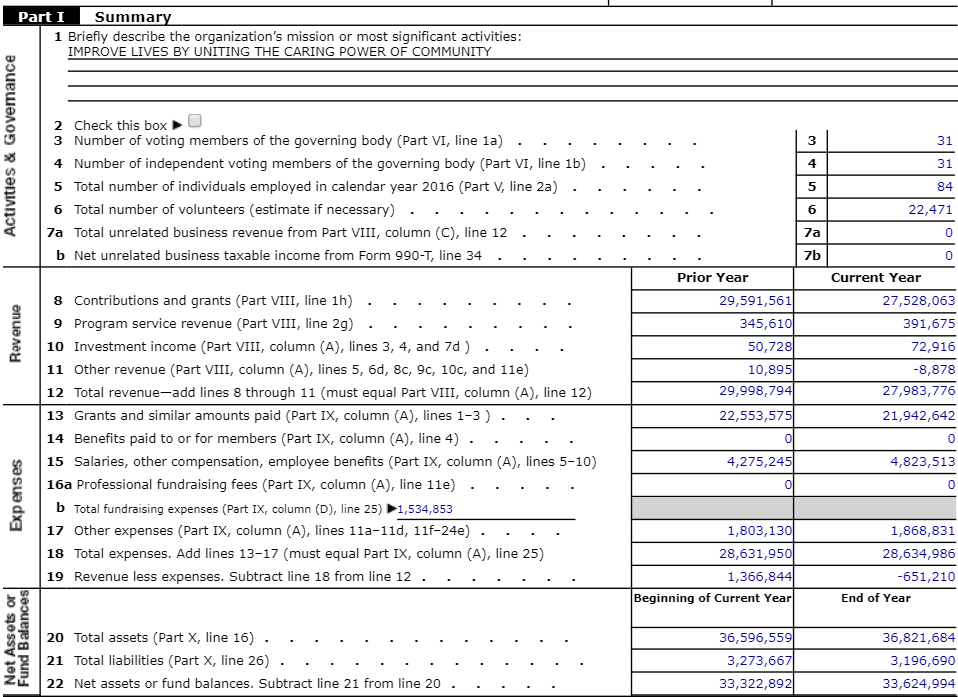

In the summary section we see the mission of the organization, “Improve lives by uniting the caring power of community.” We see the organization brought in just under $28 million in 2017, $27,528,063 was from donations, while the organization generated $391,675 in program service revenue, and $72,916 in investment income.

From that amount, the United Way paid out $22 million in grants to other organizations. Line 18 shows the total expenses of the organization, and Line 19 indicates that the organization had a loss of revenue less expenses of $651,210. Even though the organization had less revenue come in than they had expenses go out, the Net Assets or Fund Balances section shows the organization actually finished the year with more money than they had before: they started the year with 33,322,892 and ended the year with $33,624,994 – an increase of $302,102. This difference is made up of line 21 (Total Liabilities) which went down by $76,977 – meaning the organization owes less money, and an increase in assets from $36,596,559 to 36,821,684 (an increase of $225,125.)

$225,125 + 76,977 = 302,102. For this reason, it is unwise to simply look at the excess of revenue over expenses, as collecting a debt or increasing an asset (such as a Temporarily Restricted Contribution becoming “current” or usable) will not necessarily show up as revenue.

Part II, Signature Block

The Signature Block includes a section for the Treasurer or other Officer to indicate that they have reviewed the Form 990 and other documents – and also a space to indicate if there is an Accountant or other paid preparer who may be consulted in lieu of the Treasurer.

Part III. Statement of Program Service Accomplishments

Part III includes a short description of the organization’s mission, followed by an explanation of the 3 programs with the highest amount of expenses, and summarizing total program expenses. The United Way of Central Iowa has chosen to include their 3 focus areas of Education, Health and Income as their 3 largest programs along with Community Impact Services (which include the 211 helpline and other programs run directly by the United Way.)

Part IV. Checklist of Required Schedules

Part IV includes a checklist. For each box that is checked, you will need to complete the associated Schedules of the Form 990. For example, for the United Way of Central Iowa, they must complete:

- Schedule A

- Schedule B

- Schedule C Part II

- Schedule D Part IV, V, X, IX, XI, XII

- Schedule G Part III

- Schedule I Part I, 2, and 3

- Schedule J

- Schedule M

- Schedule O

Different organizations will have different requirements.

Part V. Statements Regarding Other IRS Filings and Tax Compliance

In Part V, you indicate information that helps the IRS understand your other IRS filings. For example, line 1a notes that they filed 60 forms in total for their tax compliance, while 2a indicates the organization had 84 employees. The other sections include information on income, other financial accounts (like those in foreign countries) and different types of contributions they’ve received.

Part VI. Governance, Management, and Disclosure

In Part VI, you provide information on the size of your Board of Directors (31), and questions about the organization’s finances, governing policies like Conflict of Interest or Whistleblower policies and where financial statements (like the 990) are made available.

Part VII. Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and

Independent Contractors

Part VII describes the Board of Directors, and the compensation information for key employees. Most nonprofit Boards of Directors are uncompensated, but may receive honorariums for travel or other expenses. We can see the Chief Operating Officer Sarah Roy receives $181,000 a year in salary, while Elizabeth Buck makes $158,000 a year.

Highly paid independent contractors are also listed here, if they made more than $100,000 in a year.

Part VIII. Statement of Revenue

The Statement of Revenue indicates in more detail the sources of revenue in the organization. We can see that government grants totalling $178,535 were given to the organization, while other donations included $27,349,528 and non-cash contributions (such as advertising) added up to $334,395. Other forms of revenue (beyond donations) are provided.

Part IX. Statement of Functional Expenses

The Statement of Functional Expenses includes salaries paid to employees, employee benefits, grants (the core of the United Way’s model), expenses used to provide services, and other standard line items like Legal fees, Accounting , Office Expenses and Information Technology.

Part X. Balance Sheet

The Balance Sheet is a statement that includes the amount of assets the organization holds (including cash, savings, Accounts Receivable – people who owe you), and other assets. Liabilities including Accounts Payable are the debts that the organization owes.

At the bottom of this section is Temporarily Restricted Net Assets and Permanently Restricted Net Assets. Temporarily restricted net assets are those that are restricted for a period of time. For example, you may receive a $100,000 donation with the stipulation that it not be spent for 10 years. Once the 10 years are up, it will return to general net assets. You can invest Temporarily Restricted Net Assets and spend the interest generated, but not the capital.

Permanently Restricted Net Assets are those that can never be spent. This means that even if your organization ceases to function, the Secretary of State (or similar official) of your State, will give that money to another organization serving a similar purpose.

Part XI. Reconciliation of Net Assets

The Reconciliation of Net Assets shows the total revenue and expenses along with the changes in the assets detailed above. This is how we wind up at our final total of assets, to know whether the organization is worth more (made more money) during the year than they lost – because the asset values are higher than they were at the beginning.

Part XII. Financial Statements and Reporting

Financial Statements and Reporting tells you whether the organization uses Cash Accounting or Accrual Accounting. In cash accounting, you take into account current cash balances on an immediate basis. If you spend $50 your assets go down, if you receive $100 your assets go up. Accrual accounting takes into account that you may receive revenue today that you can’t spend until next month, and you may receive bills today that are not due until next month – and takes those things into account.

Accrual accounting is the most common form of accounting in the business world and the nonprofit world, but small organizations will likely use Cash Accounting because it is simpler.

Schedules

The different Schedules included on the Form 990 are linked to with instructions at the top of the page. These instructions will help you better understand the information required for each one.

Professional Development

There are a variety of professional development opportunities for those who want to learn more about nonprofit accounting.

- NonprofitReady has a video called Nonprofit Finance Fundamentals

- Guidestar has a Form 990 Tutorial

- The IRS has a free Form 990 Overview Course

Conclusion

The Form 990 is an important form used in nonprofit tax compliance, but also has the opportunity to provide you valuable information on a nonprofit that you are considering working for or are evaluating. I hope this has been a helpful post. Please let me know if you have any questions.